Wednesday, August 12, 2015

On Wednesday, August 12, 2015 by Kuya Sid in business, file, news, online, register, registration, tax

Manual filing remains the traditional and most

widespread method of submitting various tax returns for government revenue services in the Philippines.

However, the tax environment is changing rapidly vis-à-vis the advancement of information and communication technology (ICT). As web technology is becoming more and more popular, the introduction of the internet filing has brought fundamental changes to the method of filing tax returns. In response, the BIR has introduced two (2) methods of electronic filing (e-filing) of tax returns: (1) Electronic Filing and Payment System (eFPS); and (2) Electronic BIR Forms (eBIRForms).

widespread method of submitting various tax returns for government revenue services in the Philippines.

However, the tax environment is changing rapidly vis-à-vis the advancement of information and communication technology (ICT). As web technology is becoming more and more popular, the introduction of the internet filing has brought fundamental changes to the method of filing tax returns. In response, the BIR has introduced two (2) methods of electronic filing (e-filing) of tax returns: (1) Electronic Filing and Payment System (eFPS); and (2) Electronic BIR Forms (eBIRForms).

METHODS OF ONLINE FILING

1. Electronic Filing and Payment System (eFPS)

Electronic Filing and Payment System is the electronic processing and transmission of tax return information including attachments, and taxes due thereon to the government made over the internet through the BIR website and was implemented under Revenue Regulations No. 9-2001.

Electronic Filing and Payment System is the electronic processing and transmission of tax return information including attachments, and taxes due thereon to the government made over the internet through the BIR website and was implemented under Revenue Regulations No. 9-2001.

Taxpayers intending to use the BIR eFPS facility are required to enroll through the BIR e-Lounge or may directly access BIR website for enrollment and required to maintain an online banking facility integrated with the eFPS.

How to File Tax Returns using Electronic Filing and Payment System (eFPS):

Upon successful enrollment with both eFPS and online banking with any of the Authorized Agent Banks (AABs), the taxpayer may simply access the BIR eFPS website, fill out the tax returns field with the required details, validate and submit it.

Upon successful enrollment with both eFPS and online banking with any of the Authorized Agent Banks (AABs), the taxpayer may simply access the BIR eFPS website, fill out the tax returns field with the required details, validate and submit it.

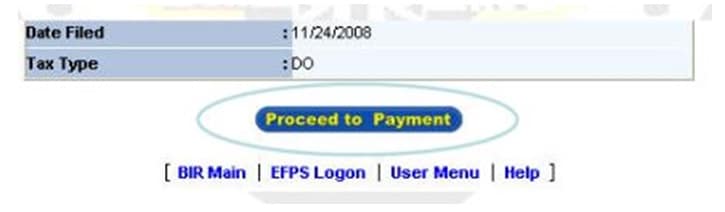

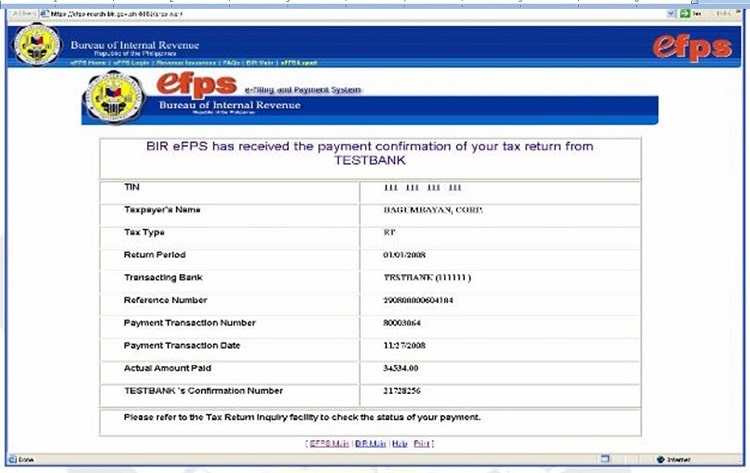

A Filing Reference Number (FRN) page is generated and displayed after a successful online filing and submission of the tax return. The system will likewise store e-filed tax returns for future reference.

If the taxpayer has a tax due to be paid, click the Proceed to Payment button at the bottom of the FRN page.

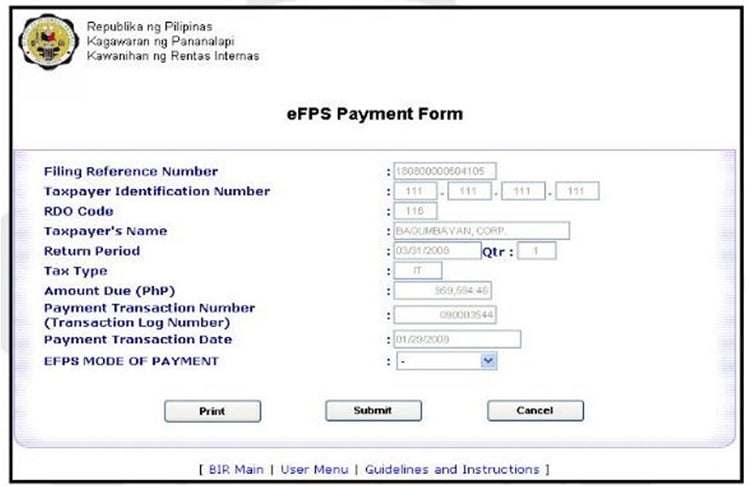

The eFPS Payment Form will be displayed with default payment information displayed and retrieved from the e-Filing service. Choose eFPS mode of payment and the authorized agent bank.

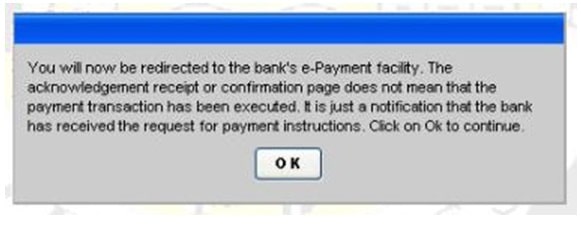

Click submit. The taxpayer’s payment instruction is submitted to the bank by redirecting the control over the participating bank’s URL.

Upon successful payment, a confirmation screen stating that the BIR eFPS has received the payment transaction will appear, as proof of successful tax payment.

2. Electronic BIR Forms (eBIRForms)

The Electronic BIR Forms (eBIRForms) was developed primarily to provide non-eFPS taxpayers and their accredited tax agents (ATAs) with an accessible and more convenient service through easy preparation and filing of tax returns and is mandated under Revenue Regulations No. 6-2014. It consists of the following:

The Electronic BIR Forms (eBIRForms) was developed primarily to provide non-eFPS taxpayers and their accredited tax agents (ATAs) with an accessible and more convenient service through easy preparation and filing of tax returns and is mandated under Revenue Regulations No. 6-2014. It consists of the following:

a. Offline Package – a tax-preparation software that allows the taxpayers and their ATAs to prepare tax returns offline with automatic computations and validation features to lessen human error.

Taxpayers with internet can download the eBIRForm Package from the BIR website (https://ebirforms.bir.gov.ph). Those without internet may copy the eBIRForms Package from the BIR RDO e-lounges through USB flash drives.

b. Online Package – a filing infrastructure that accepts, validates, processes and stores tax returns submitted online. The system creates secure user accounts for taxpayers, ATAs and Tax Software Providers (TSPs) for use of the Online System. It also allows ATAs to file on behalf of their clients. The system also has a facility for TSPs to test and certify the outputs of their tax preparation software. It is likewise capable of accepting returns data filed using system-certified TSP tax preparation software.

Taxpayers who are required to use this need to enroll by accessing the eBIRForms website. After successful enrollment and account activation, taxpayers or tax filers can already e-file their tax returns.

How to File Tax Returns using Electronic BIR Forms (eBIRForms):

- Download the latest Offline eBIRForms Package;

- After downloading the Package, exit the BIR website to avoid site traffic congestion;

- Returns can be prepared offline after installation;

- Select the form and FILL-UP by encoding data in the return;

- VALIDATE after completely encoding all the necessary information;

- A copy of the tax return can be saved by clicking the button FINAL COPY;

- Go online and click SUBMIT to electronically submit the tax return through the use of Online eBIRForms System. Taxpayer will be asked to provide a username and password.

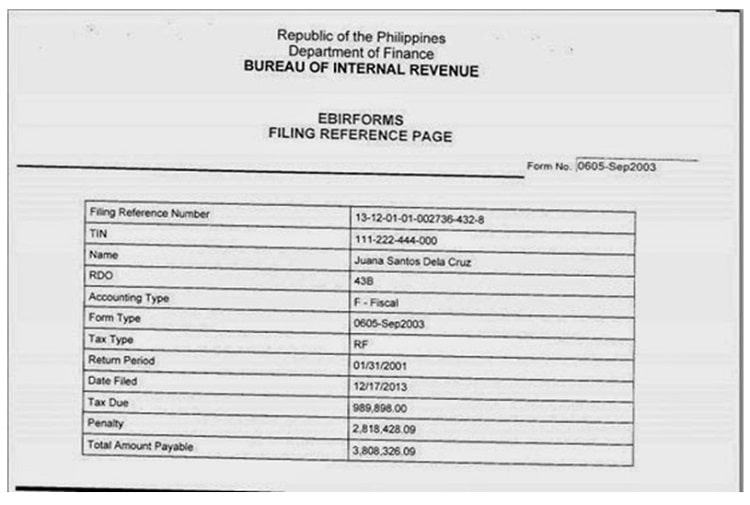

- A Filing Reference Number (FRN) will be generated in all returns as acknowledgment of its receipt along with the continue button to go to the FRN page. The page likewise displays a message “The form has been successfully filed”.

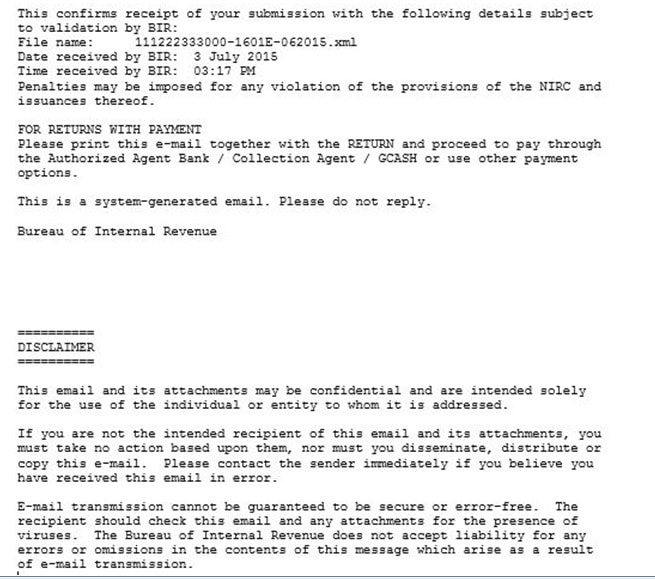

9. In case of unsuccessful submission, click FINAL COPY button to use the alternative mode of electronic submission of returns. An email confirmation will be received by the taxpayer.

Note: For those who are not yet enrolled to the eBIRForms System, it is required to fully and unconditionally agree to the Terms of Service Agreement (TOSA).

For tax returns with payment, print the tax return together with the FRN or e-mail notification and proceed to manually pay through the authorized agent bank or Collection Agent.

If no email notification is received, what shall I do?

To be able to receive the EMAIL NOTIFICATION from the BIR on the submitted tax return, make sure that all of the following are complied with:

To be able to receive the EMAIL NOTIFICATION from the BIR on the submitted tax return, make sure that all of the following are complied with:

- The email address indicated/encoded in the return is VALID and ACTIVE.

- The mailbox has enough space/not “quota exceeded”.

- BIR email is not in the SPAM folder.

- BIR website “bir.gov.ph” is NOT BLOCKED by your email provider.

Non-compliance in any of the above requires re-encoding and re-submission of the return.

If all of the above were undertaken and still NO EMAIL is received after two (2) hours from efiling, then MANUALLY e-mail the generated xml file following the steps in Annex D of RMC 14-2015.

If all of the above were undertaken and still NO EMAIL is received after two (2) hours from efiling, then MANUALLY e-mail the generated xml file following the steps in Annex D of RMC 14-2015.

If, after MANUALLY emailing following the steps in Annex D of RMC 14-2015, no email is received after two (2) hours, then call the BIR for assistance, the help desk number to call are also contained in Annex D of RMC 14-2015.

BENEFITS OF ONLINE FILING

1. Electronic Filing and Payment System (eFPS)

- Convenient and easy to use. It is quick and simple to use as well as secure.

- Interactive. Information exchange is immediate and online users get immediate feedback from the system when enrolling, e-filing or performing e-payments.

- Self-validating. Errors are minimized because all of the information supplied by the taxpayer is validated before final submission.

- Fast. Response or acknowledgment time is quicker than manual filing.

- Readily available. eFPS is available 24 hours a day, 7-days a week including holidays.

- Secure. Return and payment transactions are more secure, as all data transmission is encrypted.

- Cost-effective. Processing cost of returns and payments is minimized (e.g. receiving, pre-processing, encoding, error-handling and storage).

- All e-filed tax returns with corresponding FRN shall be deemed duly stamped received by the BIR except for Annual Income Tax returns (RR 3-2005).

- Staggered filing of tax returns based on industry classification (RR 26-2002).

- The system will store e-filed tax returns for future references.

2. Electronic BIR Forms (eBIRForms)

- Saves time because of automatic computations and auto-populated fields;

- Easy to use;

- Lessens human errors because of the validation feature;

- Available even to those without consistent internet connection;

- Captures taxpayer data; and

- Lessens manual encoding.

Who are mandated to use Online Filing?

1. Electronic Filing and Payment System (eFPS)

The eFPS was initially intended for large taxpayers with respect to some tax returns in the past but was later further developed. It is almost available to all taxpayers at their option. However, certain taxpayers are mandated to file their tax returns via EFPS as follows:

The eFPS was initially intended for large taxpayers with respect to some tax returns in the past but was later further developed. It is almost available to all taxpayers at their option. However, certain taxpayers are mandated to file their tax returns via EFPS as follows:

a. Taxpayer Account Management Program (TAMP) Taxpayers (RR 10-2014);

b. Accredited Importer and Prospective Importer required to secure the BIR-ICC and BIR-BCC (RR 10-2014);

c. National Government Agencies (NGAs) (RR 1-2013);

d. All licensed local contractors (RR 10-2012);

e. Enterprise enjoying fiscal incentives (PEZA, BOI, Various Zone Authorities, etc.) (RR 1-2010);

f. Top 5,000 Individual Taxpayers (RR 6-2009);

g. Corporations with paid-up capital stock of P10 Million and above (RR 10-2007);

h. Corporations with complete Computerized Accounting System (CAS) (RR 10-2007);

i. Procuring Government Agencies with respect to withholding of VAT and Percentage Taxes (RR 3-2005);

j. Government bidders (RR 3-2005);

k. Insurance companies and Stock brokers (RMC 71-2004)

l. Large taxpayers (RR 2-2002, as amended); and

m. Top 20,000 Private Corporations (RR2-98, as amended).

b. Accredited Importer and Prospective Importer required to secure the BIR-ICC and BIR-BCC (RR 10-2014);

c. National Government Agencies (NGAs) (RR 1-2013);

d. All licensed local contractors (RR 10-2012);

e. Enterprise enjoying fiscal incentives (PEZA, BOI, Various Zone Authorities, etc.) (RR 1-2010);

f. Top 5,000 Individual Taxpayers (RR 6-2009);

g. Corporations with paid-up capital stock of P10 Million and above (RR 10-2007);

h. Corporations with complete Computerized Accounting System (CAS) (RR 10-2007);

i. Procuring Government Agencies with respect to withholding of VAT and Percentage Taxes (RR 3-2005);

j. Government bidders (RR 3-2005);

k. Insurance companies and Stock brokers (RMC 71-2004)

l. Large taxpayers (RR 2-2002, as amended); and

m. Top 20,000 Private Corporations (RR2-98, as amended).

2. Electronic BIR Forms (eBIRForms)

RR 6-2014 mandates the use of eBIRForms to the following taxpayers:

RR 6-2014 mandates the use of eBIRForms to the following taxpayers:

a. Accredited Tax Agents / Practitioners and all its client-taxpayers who authorized them to file on their behalf;

b. Accredited Printers of Principal and Supplementary Receipts / Invoices;

c. One-Time Transaction (ONETT) taxpayers;

d. Those engaged in business, or those with mix income (both compensation and business income) who shall file a “NO PAYMENT” return (exception under RMC 12-2015);

e. Government-Owned and Controlled Corporations (GOCCs);

f. Local Government Units (LGUs), except barangays; and

g. Cooperatives, registered with National Electrification Administration (NEA) and Local Water Utilities Administrations (LWUA).

b. Accredited Printers of Principal and Supplementary Receipts / Invoices;

c. One-Time Transaction (ONETT) taxpayers;

d. Those engaged in business, or those with mix income (both compensation and business income) who shall file a “NO PAYMENT” return (exception under RMC 12-2015);

e. Government-Owned and Controlled Corporations (GOCCs);

f. Local Government Units (LGUs), except barangays; and

g. Cooperatives, registered with National Electrification Administration (NEA) and Local Water Utilities Administrations (LWUA).

Are all taxpayers required to electronically file tax returns?

Not all taxpayers are required to file electronically. Only taxpayers enumerated above are required. However, nothing prevents them from using the eBIRForms / eFPS facility of the BIR as volunteering taxpayer. The existing procedures on manual filing shall still apply.

Not all taxpayers are required to file electronically. Only taxpayers enumerated above are required. However, nothing prevents them from using the eBIRForms / eFPS facility of the BIR as volunteering taxpayer. The existing procedures on manual filing shall still apply.

Is using eBIRForms mandatory to all taxpayers?

NO. Only those taxpayers enumerated in RR 6-2014 are mandated to use and enroll in the eBIRForms System. Individual and non-individual taxpayers who do not fall under those categories may still file manually using the printed BIR Forms or file using the generated form from the Offline eBIRFoms either manually or electronically by online submission or e-Filing.

NO. Only those taxpayers enumerated in RR 6-2014 are mandated to use and enroll in the eBIRForms System. Individual and non-individual taxpayers who do not fall under those categories may still file manually using the printed BIR Forms or file using the generated form from the Offline eBIRFoms either manually or electronically by online submission or e-Filing.

Who are exempted from electronic filing?

Under Section 4(3) of RR 6-2014 and RR 5-2015, NO PAYMENT returns shall be electronically filed using the eBIRForms, however, the following taxpayers are exempted and may instead manually file their NO PAYMENT returns:

Under Section 4(3) of RR 6-2014 and RR 5-2015, NO PAYMENT returns shall be electronically filed using the eBIRForms, however, the following taxpayers are exempted and may instead manually file their NO PAYMENT returns:

a. Senior Citizen (SC) or Persons with Disabilities (PWDs) filing for their own return;

b. Employees deriving purely compensation income whether from one or more employers, whether or not they have any tax due that needs to be paid; and

c. Employees qualified for substituted filing under RR 2-98 Sec. 2.83.4, as amended, but opted to file for Income Tax Return (ITR) and are filing for the purposes of promotion (PNP/AFP), loans, scholarship, foreign travel requirements, etc.

b. Employees deriving purely compensation income whether from one or more employers, whether or not they have any tax due that needs to be paid; and

c. Employees qualified for substituted filing under RR 2-98 Sec. 2.83.4, as amended, but opted to file for Income Tax Return (ITR) and are filing for the purposes of promotion (PNP/AFP), loans, scholarship, foreign travel requirements, etc.

Do I still need to submit the e-Filed tax return to the RDO?

- For e-filed tax returns with corresponding FRN using the eFPS facility, there’s no need to submit the printed form of the tax returns to the RDO/LTDO/LT Office as it is already deemed received by the BIR (RR 3-2005), except for Annual Income Tax Returns as you will need to submit the Audited Financial Statements together with the required attachments.

- For e-filed tax returns using the eBIRForms without any attachments required, no need to submit to the RDO.

However, if there are any attachments required, submit the printed form of tax returns, together with the attachments, to the RDO/LTDO/LT Office within fifteen (15) days from the date of e-Filing.

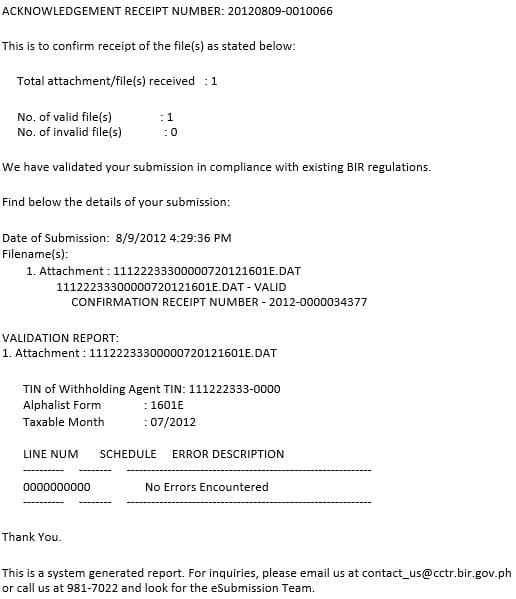

For the required attachments to be submitted such as Summary Alphalist of Withholding Tax (SAWT), Monthly Alphalist of Payees (MAP) required under BIR Form Nos. 1600, 1601-E, 1601-f, 2550-M/2550-Q and 1701-Q/1702-Q, it shall be prepared using the Data Entry Module. In the case of the Summary List of Sales/ Purchases/ Importation for all VAT taxpayers, the same is prepared using the BIR RELIEF module. All attachments are submitted to the BIR via email to: esubmission@bir.gov.ph. Validation report of the attachments generated by the BIR system shall also be included.

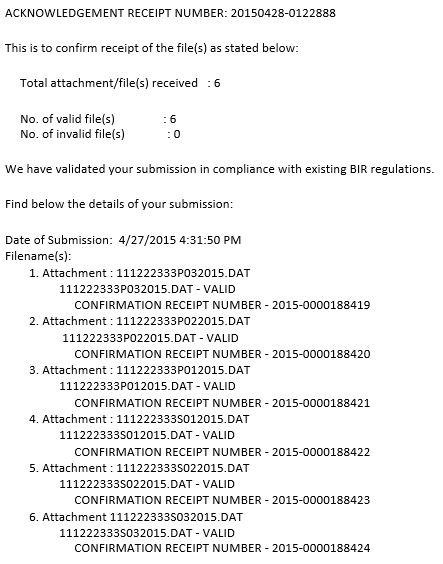

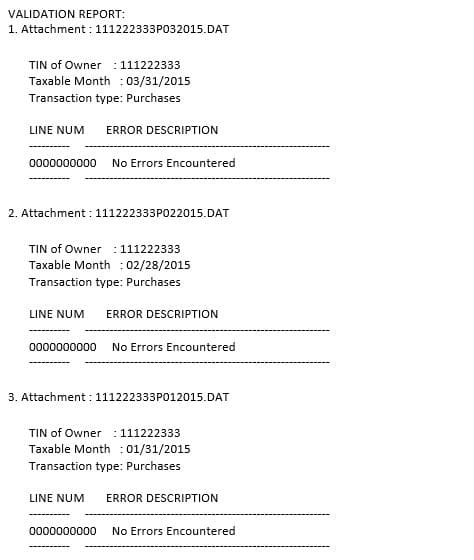

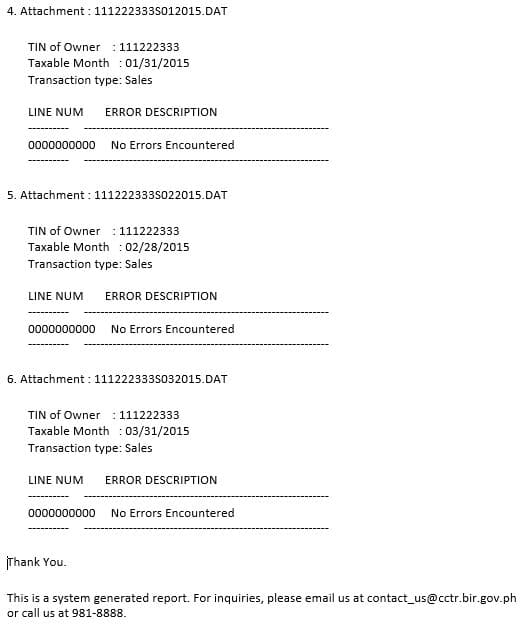

Sample validation report of Monthly Alphalist of Payees (MAP):

Sample validation of Summary Lists of Sales and Purchases (SLSP):

What BIR Forms are covered by the regulation?

The eBIRForms is an application covering thirty-six (36) BIR Forms comprised of:

The eBIRForms is an application covering thirty-six (36) BIR Forms comprised of:

- Income Tax Returns;

- Excise Tax forms;

- Value Added Tax forms;

- Withholding Tax forms;

- Documentary Stamp Tax forms;

- Percentage Tax forms;

- ONETT forms; and

- Payment forms.

For the complete list of the BIR Forms, please see this BIR webpage.

What are the penalties for failure to file returns under electronic systems of the BIR by taxpayers mandatorily covered by eFPS or eBIRForms?

All taxpayers, under the existing issuances, who are mandatorily covered to file their returns using eFPS or eBIRForms, who fail to do so, shall be imposed a penalty of P1,000 per return pursuant to Sec. 250 of the NIRC, as amended.

All taxpayers, under the existing issuances, who are mandatorily covered to file their returns using eFPS or eBIRForms, who fail to do so, shall be imposed a penalty of P1,000 per return pursuant to Sec. 250 of the NIRC, as amended.

In addition, the taxpayer shall also be imposed with civil penalties equivalent to 25% of the tax due to be paid, for filing a return not in accordance with existing regulations, thus, tantamount to WRONG VENUE filing pursuant to Section 248 (A)(2) of the NIRC, as amended.

Finally, RDOs are directed to include non-compliant taxpayers in their priority audit program.

Are those mandated to e-File but filed manually be penalized?

Yes, under RR 5-2015. If there will be an extension or waiver of penalties, the same shall be circularized in a revenue issuance.

Yes, under RR 5-2015. If there will be an extension or waiver of penalties, the same shall be circularized in a revenue issuance.

In relation to RMC 43-2008, when there are technical problems encountered in the eFPS environment during deadlines for tax filing, the authority for manual filing of all tax returns of eFPS enrolled taxpayers is given once the Information System Group (ISG) of the BIR announced thru an official memorandum and posted in the BIR web and BIR e-mail the unavailability or limited capability of the system on the deadline date or the date before the deadline. However, taxpayers are still required to lodge/file via eFPS said declarations/returns, up to the step of getting the Filing Reference Number (FRN), fifteen (15) days from the date of manual filing to ensure submission of complete and accurate return data for uploading to the BIR Intergrated Tax System (ITS).

Can the offline eBIRForms be used even when the taxpayer is enrolled in the eFPS?

Yes, all taxpayers enrolled in either eFPS or eBIRForms or those who will file manually, are encouraged to use Offline eBIRForms for ease and convenience, and to provide them ample time to encode/edit and complete their returns.

Yes, all taxpayers enrolled in either eFPS or eBIRForms or those who will file manually, are encouraged to use Offline eBIRForms for ease and convenience, and to provide them ample time to encode/edit and complete their returns.

Disclaimer: This article/guide is for general information use only and doesn’t constitute professional advice. Moreover, new and subsequent laws and tax rules may render whole or part of this article obsolete. If you see any errors, please contact us to correct them.

source:http://businesstips.ph/how-to-file-tax-returns-online-in-the-philippines/

source:http://businesstips.ph/how-to-file-tax-returns-online-in-the-philippines/